|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Utah: A Comprehensive Guide

Filing for Chapter 7 bankruptcy in Utah can be a daunting process, but it offers a fresh start for individuals overwhelmed by debt. This guide provides an overview of the essentials you need to know.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' allows debtors to eliminate most unsecured debts. This process involves selling non-exempt assets to pay creditors. It's crucial for Utah residents to understand the specifics as state laws affect the process.

Eligibility Criteria

To qualify for Chapter 7 bankruptcy in Utah, debtors must pass a means test. This test compares your income to the median income in Utah. If your income is below the median, you may qualify. Otherwise, further calculations will determine eligibility.

Exemptions in Utah

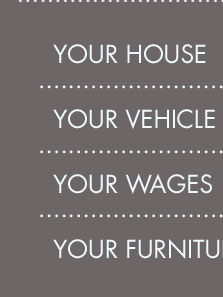

Utah allows certain exemptions that protect specific assets from being sold during the bankruptcy process. These include:

- Homestead exemption: Up to $30,000 for a primary residence.

- Vehicle exemption: Up to $3,000 in equity.

- Tools of the trade: Up to $5,000 for tools necessary for your occupation.

The Filing Process

Filing for Chapter 7 bankruptcy involves several steps:

- Credit counseling: Complete a credit counseling course from an approved agency.

- Filing the petition: Submit necessary forms and pay the filing fee to the Utah bankruptcy court.

- Automatic stay: Once filed, an automatic stay halts most collection actions against you.

- 341 meeting: Attend a meeting of creditors where a trustee reviews your case.

- Discharge: If successful, debts are discharged, typically within three to six months.

Life After Bankruptcy

After a successful discharge, individuals can start rebuilding their financial lives. While it remains on your credit report for ten years, many find relief in being free from debt.

Consulting professionals like a riverside bankruptcy attorney can help navigate the complexities of bankruptcy law and ensure all necessary steps are followed.

Common Misconceptions

Bankruptcy Ruins Your Credit Forever

While bankruptcy does impact your credit score, many find they can rebuild their credit with responsible financial habits.

All Debts are Wiped Clean

Not all debts are dischargeable. Student loans, certain taxes, and alimony often remain.

FAQ Section

How long does the Chapter 7 process take in Utah?

The process typically takes three to six months from filing to discharge.

Can I keep my car if I file for Chapter 7 in Utah?

Yes, if the equity is within Utah's exemption limit, you can keep your car.

Do I need an attorney to file for Chapter 7 bankruptcy?

While not required, hiring an attorney like a rochester bankruptcy attorney can provide guidance and improve your case outcome.

To qualify for relief under chapter 7 of the Bankruptcy Code, the debtor may be an individual, a partnership, or a corporation or other business entity. 11 ...

Chapter 7 Individual Debtor Bankruptcy Petition Package ; 107, Your Statement of Financial Affairs for Individuals Filing For Bankruptcy (individuals), Filed ...

In a Chapter 7 Bankruptcy Case, all of a Debtor's non-exempt property becomes the property of the bankruptcy estate at the time of filing and may be sold by the ...

![]()